Africa holds almost thirty per cent of the world’s capacity to remove carbon from the atmosphere yet earns less than three per cent of global carbon credit revenues. That imbalance represents a serious cost for African businesses in energy, mining, cement, agriculture, and transport. Those who act now can capture financial reward, credibility, and competitive advantage. Those who wait will face mounting risks and lost opportunities.

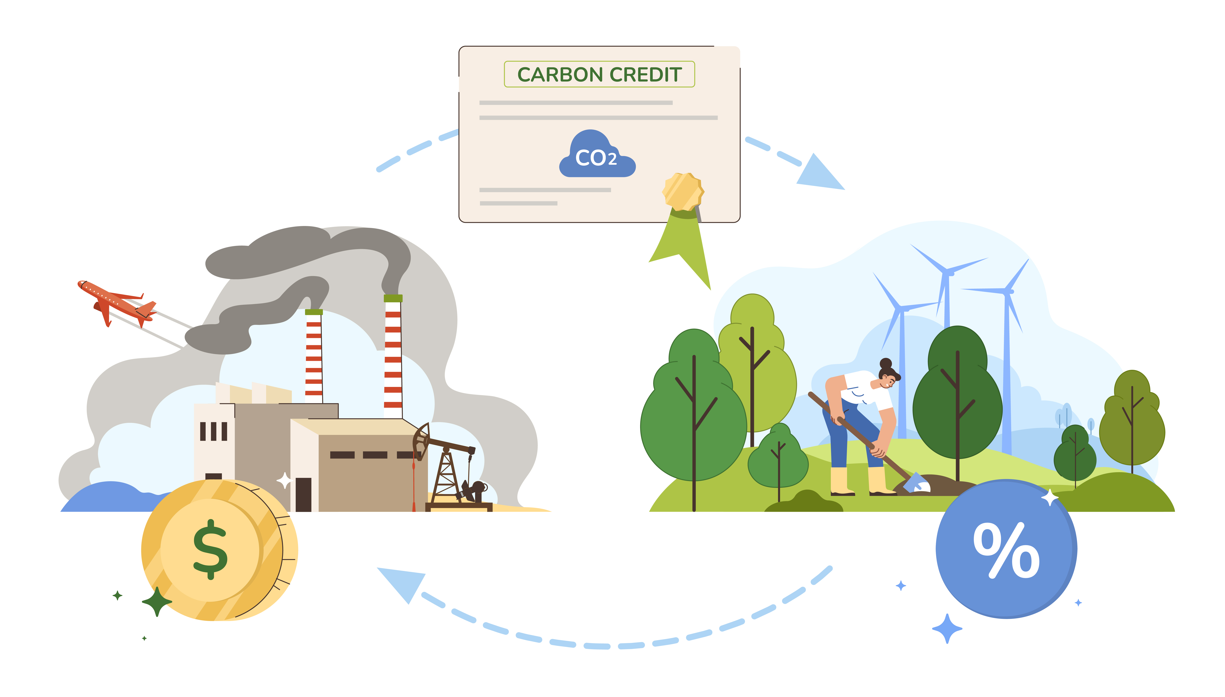

The voluntary carbon market is expected to surpass USD 50 billion by 2030. For African companies with large carbon footprints, credits are more than an environmental instrument. They are a business strategy. Carbon credits can generate new revenue from emission reductions, protect firms against regulations such as the EU Carbon Border Adjustment Mechanism, and signal to investors that companies are serious about sustainability. The companies that integrate credible strategies today will be the ones securing financing and market access tomorrow.

Gabon has already shown what is possible. In 2019, the country signed a USD 150 million deal with the Central African Forest Initiative to protect its forests. By 2021, independent verification confirmed that Gabon had avoided over three million tonnes of CO₂ emissions, leading to a USD 17 million payment. This was not aid but earned income tied to results.

Kenya provides another example. Through the Kenya Agricultural Carbon Project, more than thirty thousand smallholder farmers have adopted practices such as agroforestry and soil improvement. They now receive additional income from carbon credits while improving resilience and productivity. It shows that climate-smart practices can generate bankable outcomes.

Nigeria, however, illustrates the cost of inaction. In the first two months of 2025 alone, the country flared 22.3 billion standard cubic feet of gas. That released more than 1.2 million tonnes of CO₂ and wasted an estimated USD 78.2 million in value. Every flare stack is not only a source of pollution but also a missed opportunity to generate carbon credits through methane capture and energy recovery.

The potential extends across sectors. Energy companies can cut flaring, repair methane leaks, and integrate renewables. Mining firms can rehabilitate degraded sites, reduce operational emissions, and access climate finance tied to verified reductions. Cement producers, responsible for about eight per cent of global CO₂ emissions, can adopt alternative fuels and carbon capture to both lower costs and create tradable credits. Even transport and logistics companies, by electrifying fleets and improving efficiency, can reduce exposure to levies while improving their competitive position.

Yet the barriers are clear. Weak governance erodes trust in many African projects. Technical expertise is limited, and most businesses lack robust carbon accounting systems. Low awareness means many executives still see carbon credits as abstract rather than a practical financial tool. These weaknesses have led to undervalued African credits and underinvestment in home-grown solutions.

This is precisely where CSR-in-Action, in collaboration with Carbon Direct, is stepping in. Together, we help companies move beyond vague commitments by providing science-based carbon accounting and credible pathways to verified credits. We support firms in measuring their true carbon footprint, identifying opportunities for reduction, and building projects that meet international standards. By doing so, we help African businesses avoid greenwashing risks, attract investors, and compete in global markets on equal terms.

Africa’s forests, fields, oil reserves, and mines hold immense potential, but the window is narrowing. Every tonne of gas flared without capture and every hectare of forest lost without verification is money and credibility slipping away. Carbon credits are already reshaping markets worldwide. The choice before African businesses is whether they will lead in this transformation or bear the cost of waiting.